Table of Content

This form will help you in the removal of the hypothecation clause from your RC . One of the most important formalities to do after paying the home loan amount in full is to obtain the No Dues Certificate from the respective lender. This legal document is a proof that you have repaid the full loan amount and penalties if any. This document generally mentions important details like your property address, name of the applicants, loan amount, loan account number, date of starting, and the closure of the loan. While obtaining the NDC, You should also make sure that it is duly signed and has the official stamp of the lender. You need to analyse your financial situation before paying off the entire loan amount at once.

Being a leading public sector banking institution in the country, IOB’s Subha Gruha home loan scheme can be the ideal partner for funding your housing dream. This loan is available for a wide range of housing requirements, open for application to the likes of resident Indians as well as NRIs. It is best to opt for an Indian Bank home loan prepayment during the first few years of the loan. If you are not an individual borrower, then the bank is allowed to charge prepayment. You should never use your emergency fund for making your home loan prepayment.

Obtaining the Indian Bank Home Loan Statement and Interest Certificate offline

Indian Bank’s Personal Loan for Self Employees is a loan product offered to self-employed individuals and in need of funds. The bank provides them with attractive rates of interest on their personal loan and tenure of months. Indian Overseas Bank offer housing loans to eligible customers at an interest rate that starts from 8.75%. With a maximum loan repayment tenure of 30 years and a processing fee that starts at as low as 0.50% of the loan amount along with other benefits, it is worth your consideration.

We provide you with the lowest personal loan interest rates available for you. As discussed earlier, banks often levy a penalty ranging from 0.5% to 5% of the outstanding loan amount, when you choose to prepay. You must get in touch with your bank to know the exact amount of penalty charged by the bank. This will help you stay prepared with the requisite funds.

Indian Overseas Bank(IOB) Home Loan FAQs

The natural intended course of the loan takes place and the loan is resolved as per the tenure agreed on application of the loan. You can submit post-dated EMI cheques from a non-Indian Overseas Bank account at your nearest Indian Overseas Bank Loan Centre. A fresh set of PDCs will have to be submitted in a timely manner. Please note Post Dated Cheques will be collected non-ECS locations only.It is recommended that you opt for either the SI or ECS mode of payment for faster and less prone to error than the use of PDCs. Your Indian Overseas Bank personal loan can be repaid in following three ways. Repayable in equated monthly instalments for a maximum period of 30 years.

But there are some formalities you need to do after you paid the loan in full, irrespective of what kind of loan you have taken, and it is important to know about each of them. So, we will be telling you about the closure formalities for each of the loans so that you don’t face any difficulty while closing them. For people who don't want a burden of accumulated debt can opt for pre-closure of their Personal Loan, but that calls for a penalty from the lender.

Reasons for Home Loan Pre-Closure

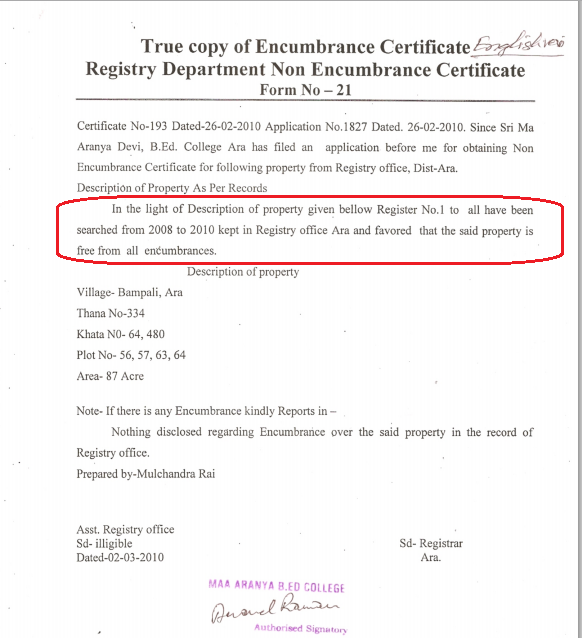

If the original Home Loan account is closed and no other HL Plus liabilities exist against that property, then fresh HL Plus cannot be considered. Possession of the house / flat has been taken by the borrower and valid mortgage has been created in favour of the Bank. CreditMantri is India’s No. 1 site for Credit Analysis and Free Credit Score Online. Let us help you take control of your credit goals and unlock the door to your financial freedom. Margin ranges from 10% to 25% of the estimated cost for new as well as old houses/flats, depending upon the loan quantum.

You can initiate the pre-closure of a Personal Loan online by visiting the official website of the bank. Indian Bank enables a Personal loan borrower to make a pre-closure or a pre-payment of a loan. However, you will be able to prepay your Indian Bank Personal Loan only after 12 months after you have procured your loan and after paying 12 EMIs plus the foreclosure charges that may be applicable. If you meet this requirement, you can repay your personal loan before the original due date and close your loan early. Indian also offers a prepayment facility to help the customers pay off the entire outstanding or a part of it. If you have a surplus amount of money in hand and meeting the below criteria then you can pay a part of your principal outstanding amount to reduce the same.

We are one stop shop for all types of lending solutions. We manage the entire borrowing process for clients, starting by assisting our clients to choose the right product from the appropriate lending organization,till the time, the entire loan is disbursed. Preclosing a housing loan means that you lose a big chunk on money in one go. This can be beneficial in saving interest but becomes a burden to an individual as he/she loses out on a lot of money instantly, often damaging the lifestyle of that person. As part of our efforts to make the end consumer services affordable and available at price points which are favourable to the customer, CreditMantri may receive fees / commissions from lenders.

Collecting the No Objection Certificate – The No Objection Certificate or NOC is a statement by the bank acknowledging that you have paid all your dues. Not to release the title deeds of the house property till the Top up loan is also completely adjusted. • The Home Loan should have completed at least one year of satisfactory repayment. Eligibility– All existing Home Loan borrowers (Residents & NRIs) including HL-CRE / IB Home Advantage / HL for Repairs and Renovation which are under ‘Standard’ Category. This mode can be used if you have a non-Indian Overseas Bank account and would like your EMIs to be debited automatically at the end of the monthly cycle from this account. The bank is operating with about 3700 domestic branches, including 1150 branches in Tamil Nadu, 3 extension counters, and eight branches and offices overseas as of 2014.

Step 3 - You need to provide the agreed interest rate of your existing home loan. Come July-end and we find ourselves rushing to get our financial documents in order, boo... Once you submit the cheque or the demand draft, the bank will issue an Acknowledgement Letter stating the receipt of the funds.

Home renovation schemes shall be offered with a 0.5% interest rate hike. The first and foremost requirement is that the customer is based in India. In the case of non-residents, there needs to be proper documentation to show their citizenship status. The Indian Bank Home Loan scheme comes with an array of features and benefits suited to the needs of its various customer classes. These features make the scheme a lucrative option to consider. Some of the major features and benefits of availing of the Indian Bank Home Loan scheme are as follows.

Indian Bank home loan rates offer customers an attractive solution for their financial needs. The scheme can be said to be one of the best financial products available in the market. Indian Bank home loan EMI calculation is a straightforward mathematical process, but it can get complicated when doing manual calculations. One can simply resort to using an Indian Bank Home Loan EMI Calculator, an excellent AI-powered online tool that computes the outcome of a loan in terms of the structuring of EMI. Using an Indian Bank Home Loan online calculator saves time and energy and shows users real-time outcomes.

You can apply for an Indian Bank personal loan balance transfer to lower your financial burden. Home Loan Pre-Closure can help borrowers save a significant amount of money through interest savings. But the option should be used carefully after considering the mortgage loan pre-closure charges and your current expenses. You can consult your lender to know more about loan prepayment and the exact amount you will be saving after deducting the penalty. This is probably the only bank that provides several home loan products in India.

You can simply enter the loan amount, rate of interest, tenure, installments paid and the prepayment amount to fetch the results. A borrower can also preclose a housing loan to save up on interest. Closing off a loan before the term is due allows the borrower to evade a part of the interest. Any interest he/she was supposed to pay post preclosure will automatically be waived off on closing the loan. However, one must take into consideration the home loan preclosing charges that a bank may charge before preclosing.

No comments:

Post a Comment